Despite what many would consider a tumultuous past few months, world stock

markets rallied from late August lows to finish slightly higher for the third quarter

of 2019. In the US, the S&P 500 inched up 1.2% for a YTD gain of 19%, extending the

longest bull market on record. Developed international markets declined slightly while

emerging markets continued to lag. Bonds settled higher with the yield on the 10 US

Treasury bond falling to 1.67%, highlighting a rare instance where both risk assets and

safe assets increased in value, reflecting investor’s unease with the path of the global

economy.

|

|

3rd Quarter

2019 |

YTD

2019 |

| S&P 500 |

1.70% |

20.55% |

| Russell 2000 |

-2.40% |

14.18% |

| MSCI EAFE (Net) |

-1.07% |

12.80% |

| MSCI Emerging Markets (Net) |

-4.25% |

5.90% |

| Bloomberg Barclay's U.S. Aggregate Bond |

2.27% |

8.52% |

| Source: Zephyr StyleADVISOR |

Through the end of 2019, investors will likely focus their attention on three primary

areas: the global economy, trade issues and what the US Federal Reserve (the Fed)

may do. Although each can be viewed on a stand-alone basis, the interplay between

them may have a meaningful impact on market returns across all asset classes.

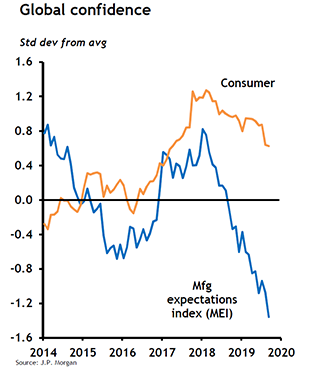

While the US economy remains on a stronger footing than most of its international peers, worldwide economic growth is

clearly slowing. Europe’s economy may have ground to a halt with recent measures of business activity the lowest in 6

years. China’s economy has also continued to slow, albeit to a rate that is still outpacing other major developed nations.

Forecasts of GDP for the US have continued to decline but are not yet indicating an elevated probability of imminent

recession, even though a recent Wall Street Journal poll of economists suggests that the manufacturing sector is in

recession and the service sector is posting much slower growth. And what do market observers point to as a primary

drag on economic growth? Trade uncertainty.

Trade issues have dominated the financial headlines for much of 2019 and the third quarter was no exception. A resolution

to the trade dispute between China and the US has proven elusive and the fit-and-start nature of negotiations has been

disruptive to businesses worldwide. In the US, agriculture has been especially hard hit with implications for farmers and

ancillary businesses like manufacturing and transportation. While China has recently stepped up purchases of some

agricultural products like soybeans, shipments remain far short of pre-trade war levels. Some wonder if China is merely

trying to buy their way out of the trade dispute rather than address the structural reforms that the US is insisting upon.

For many, the seemingly ad hoc nature of tariff impositions

and the tit-for-tat response by each nation has created an

atmosphere of uncertainty that has left many businesses

unwilling to commit capital to business expansion,

exacerbating the economic growth issues highlighted

above. All of this has not gone unnoticed by the Federal

Reserve.

The third quarter was a busy one for the Fed with cuts to

interest rates in both July and September in an attempt to

prolong the economic expansion. Just a year earlier the

Fed was raising rates but has now joined along with 16

other central banks in lowering rates in the third quarter.

A recent release of notes from the September Fed meeting

show officials growing more concerned about weakness

from trade and slowing global growth and the deleterious

effect they may have on domestic hiring. Job growth has

slowed as of late but remains steady and wage pressures

are muted. Those factors along with a lack of inflation

pressure may mean that the Fed has room to comfortably

reduce interest rates further - although the amount and

timing of further cuts is an open issue as a minority of Fed

members questioned whether any additional cuts were

needed at all. Above all, the Federal Reserve needs to

maintain its independent role and not allow its decisions to

be influenced by other government entities.

Markets enter the fourth quarter in a somewhat fragile state

and it’s important that investors not get caught up in the

noise being generated on a daily basis. A well-diversified

investment portfolio that is rebalanced periodically and

structured for long-term results is a great antidote to the

impulse to react (or over-react) to the 24/7 news cycle. It is

also a great time to meet with your advisor to ensure that

you’re well-positioned for 2020 and to discuss any tax or

planning issues before year-end.

Data as of 9/30/19

This material is provided for general information purposes only. Investments and insurance products are not FDIC insured, not bank deposits, not obligations of, or guaranteed by Canandaigua National Bank & Trust or any of its affiliates. Investments are subject to investment risks, including possible loss of principal amount invested. Past performance is not indicative of future investment results. Before making any investment decision, please consult your legal, tax or financial advisor. Investments and services may be offered through affiliate companies.